If you’re like many Irish savers, you might have a substantial portion of your wealth sitting in a low-interest bank account. While this may feel like a safe and secure way to manage your finances, it could actually be costing you money in the long run. Even low inflation has a significant long-term impact.

Deposit Interest Rates and Inflation

Most major banks in Ireland currently offer minimal interest on savings accounts, often well below 1%. Taking inflation into account, keeping your money in an account where it’s not growing means that your spending power will reduce over time.

For example – let’s says you have €50,000 sitting in your bank account.

If we consider an inflation rate of 2.5% (keeping in mind that Ireland’s annual inflation rate was 3.75% in September 2021), in ten years, that €50,000 will be worth only €39,060 in today’s terms. Simply put, the larger the deposit you have sitting in your bank account, the more money you are losing!

Why people stick to Saving Accounts instead of opting for a greater return with an Investment Bonds?

Despite the fact that deposit interest rates do very little to protect your funds, many people in Ireland still choose to keep their money in traditional savings accounts. The main reasons are:

- Fear of Risk – Market volatility

- Lack of investment knowledge – simply not knowing the options available and worry about making the wrong choice

- Short-Term Needs – Unexpected or emergency needs

While these concerns are understandable, they shouldn’t stop you from exploring current alternatives that provide better long-term protection against inflation.

Investment Bonds as an alternative

With an investment bond, your cash is invested in a tailored combination of funds that align with your risk profile and offer a strategic blend of assets, aiming to optimise returns while managing risk effectively. Your money can be invested in a range of investment funds, with the potential for higher, inflation-beating returns over the long term.

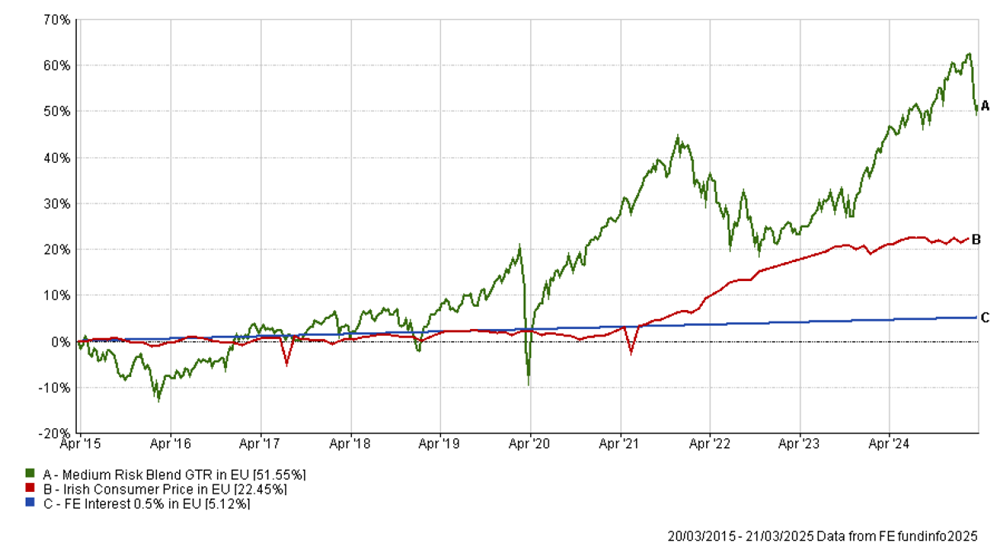

Here is an example comparing a Medium Risk Blend with a deposit rate of 0.5% and the CPI inflation over a 10-year period:

Source: FE fundinfo. Medium Risk Portfolio includes a standard annual management Charge.

These are gross figures based on compound interest and don’t take tax liabilities into account.

As shown above, in a fixed-term deposit, your money could grow nominally but lose purchasing power due to inflation. In contrast, with a Medium Risk portfolio, your investment could unlock greater returns, preserving and increasing your real wealth.

It’s important to know that any small growth from a deposit account is subject to deposit interest retention tax (DIRT) at 33%, while investment bonds have an exit tax of 41% on any growth plus a 1% government levy on the amount invested.

What to do Next?

If you’re looking for savings and investment opportunities, we offer a variety of options tailored to your saving preferences and goals. The key is to educate yourself and understand the terms and potential outcomes of your investments and savings plans, as this is essential for financial security. Consulting with us at Derradda Financial Services will ensure you comprehend your options and make informed decisions.

Get in touch to find out how we can help.

📞Call us: Dublin Office 01 2330209 / Galway Office 091 399256

📧 Email us: info@derradda.ie

| Warning: Past performance is not a reliable guide to future performance. Warning: The value of your investment may go down as well as up. Warning: Benefits may be affected by changes in currency exchange rates. Warning: If you invest in this product you may lose some or all of the money you invest. |