Building financial security requires a clear vision and persistent effort. Whether you’re focused on paying off debt, buying a home, or preparing for retirement, setting specific financial goals is key to taking control of your finances. The decisions you make now can make all the difference to your lifestyle in retirement. Without a strategy, it’s easy to fall into a cycle of living paycheck to paycheck, feeling stuck and uncertain about the future.

By defining your priorities and creating actionable plans, you can pave the way to a stable financial foundation. Goals can range from tackling short-term challenges like credit card balances to working toward long-term dreams such as a comfortable retirement. These objectives serve as stepping stones, guiding your decisions and helping you approach financial challenges with confidence.

This guide provides a roadmap for setting and achieving financial goals, empowering you to navigate obstacles and stay on track toward lasting stability and peace of mind.

Setting Long Term Financial Goals

Saving for retirement is often the cornerstone of long-term financial planning. To ensure your retirement savings align with your future needs, it’s important to estimate how much you’ll require maintaining your desired lifestyle.

Estimating Your Retirement Needs

If you’re earning €50,000 a year, the current State Pension is just over a quarter of that—around €12,500. Is that enough to maintain your lifestyle in retirement?

Planning with our Pension Calculator

Planning for your retirement is essential, and our pension contribution calculator is here to assist you in understanding what your future might look like financially. By inputting details about your pensions, such as your age, the age you want to retire, how much you’d expect to have in a month in retirement, and your existing pension fund, you can gain valuable insights into your potential retirement income.

<<Link to our Pension Calculator>>

What is The 4% Rule?

A guideline for retirement planning is the “4% rule.” This principle suggests that if you withdraw 4% of your total retirement savings annually—adjusted for inflation—you can sustain your finances for approximately 30 years. For example, with a €1 million pension fund, withdrawing €40,000 in the first year and increasing withdrawals to keep pace with inflation, you would have made it through any 30-year retirement without running out of money. While not fool proof, this strategy provides a useful benchmark for long-term planning.

Where to Start With Retirement Planning?

– Calculate Future Expenses: Estimate your annual living costs during retirement, factoring in potential increases, such as healthcare expenses.

– Account for Guaranteed Income: Deduct income from state pensions, personal pensions, property, investments, and other retirement plans from your expenses.

– Assess Your Savings Gap: Determine the remaining amount that needs to be funded by your investments. Tools like our Pension calculator can help estimate the required savings to meet your goals.

Maximise Your Pension Contributions: A Smart Strategy for Retirement Savings

Building a strong retirement fund is crucial, and maximising your personal pension contributions is one of the most effective ways to achieve this. By taking full advantage of the tax relief available, you can significantly enhance your retirement savings.

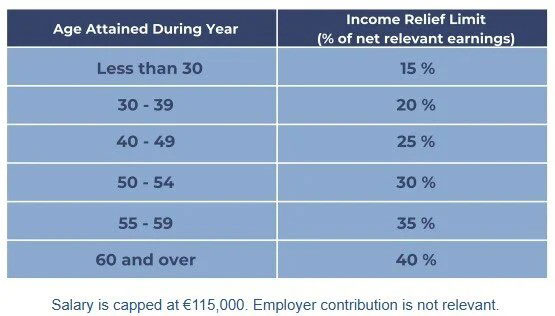

The below table, outlines the contribution caps based on age and the percentage of tax relief you can claim, based on your net relevant earnings.

Understanding The Contribution Caps

If you earn €50,000 annually and are 45 years old, you can contribute up to 25% of your earnings – €12,500 – to your pension each year. With a tax relief rate of 40%, you’ll effectively save €5,000 on your tax bill with an immediate refund, making this a highly beneficial investment.

Employer Contributions: A Valuable Boost

If your employer also contributes to your pension, this is an invaluable opportunity to boost retirement savings.

For example, if your employer adds 5% of your salary to your pension, the combined contributions amount to 30% of your salary – total contributions of €15,000 annually. Remarkably, this would only cost you €7,500 after tax relief.

Start Early to Maximise Growth

Cathal McHugh, Managing Director of Derradda Financial Services, says “Starting your pension contributions early in the calendar year rather than waiting until the November tax deadline has it’s benefits. By contributing earlier, your savings benefit from compound interest over a longer period, potentially leading to much greater growth by the time you retire.”

Taking proactive steps now to optimise your pension contributions can make a substantial difference in your financial future.

Staying The Course

Achieving financial milestones like retirement requires discipline, flexibility, and periodic adjustments. Life’s uncertainties may shift your goals, but regularly reviewing and adapting your financial plan ensures you remain on track. Whether building an emergency fund, eliminating debt, or saving for retirement, consistency is key.

The role of a financial broker today is more important than ever. Make sure you invest time to discuss your options and to put a financial plan in place.

By setting achievable, measurable targets and monitoring your progress, you can navigate the complexities of financial planning and secure a more stable and stress-free future.